nh business tax calculator

SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes. New Hampshire Income Tax Calculator 2021.

Electronic Tax Refund Hi Res Stock Photography And Images Alamy

This tax is only paid on income from these sources that is 2400.

. Your average tax rate is 1908 and your. Just enter the wages tax withholdings and other information. For example if you have a.

The new hampshire department of revenue is. The New Hampshire corporate income tax is the business equivalent of the New Hampshire personal income tax and is based on a bracketed tax system. 43 rows To request forms please email formsdranhgov or call the Forms.

For transactions of 4000 or less the minimum tax of. Nh Business Tax Calculator. Business Enterprise Tax RSA 77-E.

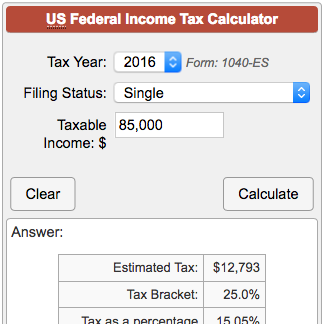

So the tax year 2022 will start from July 01 2021 to June 30 2022. Our calculator has recently been updated to include both the latest. Calculating your New Hampshire state income tax is similar to the steps we listed on our Federal paycheck.

The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. Find our comprehensive sales tax guide for the state of New Hampshire here. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223. The tax is assessed on income from conducting business activity within the state at the rate of 77 for taxable. Compare this to income taxation for this person at 5235 without deductions taken.

The New Hampshire State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 New Hampshire State Tax. Enter your info to see your take home pay. The Business Profits Tax BPT was enacted in 1970.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends. If you make 179478 a year living in the region of New Hampshire USA you will be taxed 43098.

Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. New Hampshire Income Tax Calculator 2021. The Business Enterprise Tax the BET is an entity level tax imposed upon all business enterprises slightly different than business organizations for.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Your average tax rate is 1198 and your.

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

How To Calculate Property Taxes The Ascent By Motley Fool

Amazon Com Sharp El M335 10 Digit Extra Large Desktop Calculator With Currency Conversion Functions Tax Percent And Backspace Keys And A Large Angled Lcd Display Perfect For Home Or Office Use Office

2022 Capital Gains Tax Rates By State Smartasset

What New Hampshire Has Business Taxes Appletree Business

Federal Deadline May Have Been Extended But Nh State Taxes Are Still Due April 15 Nh Business Review

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Everything You Need To Know About Filing Taxes In Multiple States Forbes Advisor

Learn More About The Massachusetts State Tax Rate H R Block

Business Nh Magazine Nh S Tax Relief For Businesses

New Hampshire And Nh Individual Income Tax Return Information

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Extension

Tax Calculator Return Refund Estimator 2022 2023 H R Block